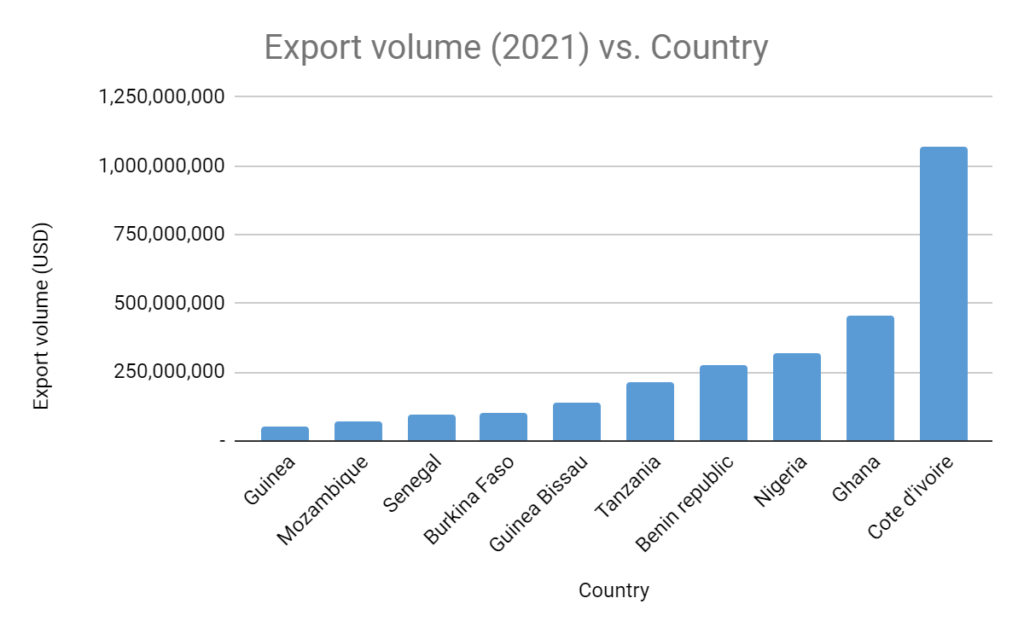

Held in high esteem throughout producing regions of Africa continent, raw cashew nuts exports have represented a significant portion of the income of rural communities and national agricultural export revenue. Africa dominates the raw cashew nut industry, producing 46% of the global total and earning about $2.8 billion in 2021 from its 90% share of the annual export RCN supply (OEC) (UNCTAD). From West to East Africa, with Cote d’ivoire in the lead, Ghana, Nigeria and Tanzania are among the continent’s top producers & exporters. The cashew season of the continent is unique with nearly all year round availability, allowing for uninterrupted trade for international buyers.

The African cashew industry, renowned for its superior nut count and flavor, is still facing several challenges that have limited its full potential and sustainability. These challenges, as highlighted by the African Cashew Alliance and USAID, include declining yield quality, labor-intensive harvesting and processing techniques, persistent cases of child labor, underdeveloped rural communities with limited access to financial and internet services, and unreliable market information systems, among other factors.

Graph 1. Top exporting African countries of raw cashew nuts by value in 2021.

Source: OEC (HS Code: 080130) (USD)

The value chain begins with farmers and farm families in rural communities such as Ogbomoso in Nigeria, Mwtawara in Tanzania or Bondoukou region in Cote d’ivoire, buying agents/licensed commodity exchange scouts comb every community to establish verbal price and quantity agreements, gather market information and form new trade relationships for the new season of fresh raw cashew nuts. Upon fruit ripening and drop, the fresh nuts are detached from the apples, sorted, dried and bagged. Intermediaries buy bagged nuts from farmers. The structure and formality of these intermediaries are country specific such as informal trade by commodity aggregators/exporters as seen across West Africa or formal government commodity exchange boards as in Tanzania (East Africa).

This system of basic nut processing (sun drying, manual sorting and bagging) has lasted for as long as the cashew nut trade existed on the continent. Notably, Vietnam and India are prominent buyer destinations for African cashew nuts, accounting for approximately 85% of exports and involving deshelling processes (UNCTAD, 2021).

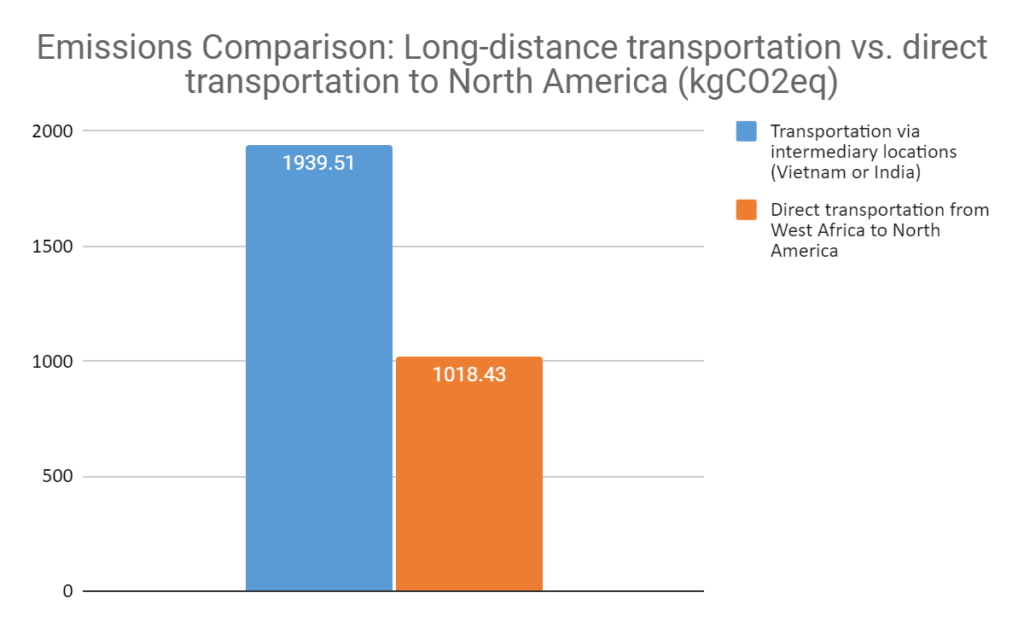

Research conducted by Agyemang and colleagues in 2016 indicates that the transportation of one metric ton of Raw Cashew Nuts (RCN) from small-scale mechanized operations in West Africa to intermediary locations (Vietnam or India) and subsequently to the US results in an estimated emission of 1939.51 kgCO2eq. Conversely, direct transportation of RCN to North America leads to significantly lower emissions, totaling only 1018.43 kgCO2eq (approximately 53% less).

Graph 2. Emissions comparison for one metric ton of Raw Cashew Nuts via intermediary locations vs. direct transportation to consumer destinations. Source: Agyemang and colleagues, 2016

Considering the extensive travel distance, African cashew kernels arrive in Europe and the US (over 30,000 kilometers from origin, where they undergo final processing and are sold to consumers at a substantially higher price (around 8.5 times) compared to what smallholder producers receive (UNCTAD, 2021). This raises questions about the environmental impact, profitability, and living standards within the industry and value chain. A comprehensive evaluation is necessary to understand the long-term implications on sustainability and the well-being of farmers.

Defining ESG and Carbon Footprint

Environmental, Social and Governance (ESG) refers to a framework used to evaluate and report an organization’s business conduct and performance on sustainability matters. Although more applicable to a set of criteria used by investors to evaluate an organization’s impact so as to inform investment decisions. ESG, if properly incorporated into an organization’s culture ensures long-term sustainability, impact and competitiveness.

According to the Nature Conservancy, “A carbon footprint is the total amount of greenhouse gases (including carbon dioxide and methane) that are generated by our actions”. The core of Carbon footprint is the quantification of emission and enabling a sustainable transition to decarbonization across the supply chain.

As all sectors of the economy are unique and faced with different ESG issues, it is important to critically investigate the relevant areas in the cashew industry for appropriate measures.

Current ESG and carbon footprint issues in the cashew nut export value chain

With growing population and demand for cashew products globally as well as the rising trend of eco-friendly consumerism, African cashew farmers and other industry players face an urgent need to find and implement eco-friendly methods that can help them meet growing demand, achieve profitability, and safeguard the environment.

Full product traceability remains a major challenge especially for plantation management as almost no documentation exists on farmer’s practices. The absence of traceability limits farmer’s potential to earn premium income, makes it difficult to obtain empirical evidence on the environmental impact of such practices and lowers companies’ confidence on the true sustainability rating of their products.

To meet the expectations of sustainability-minded investors and customers, an alarming trend within the global agri-food sector is the rise of “greenwashing” among global value chain actors who make unsubstantiated claims about environmental, social, and governance (ESG) practices, without the necessary verifiable data. As a result, the credibility of sustainability efforts is compromised, diluting the overall impact of authentic initiatives.

Environmental challenges have a direct bearing on the overall productivity of the cashew sector, necessitating immediate action. Adverse impacts caused by extreme climate conditions on farms, farming communities, and support services, coupled with the consequences of deforestation, pesticide misuse, and the substantial greenhouse gas emissions arising from the wastage of over 10 million tons of cashew apples, pose significant hurdles. With just 10% of annual apple production being processed into value-added products such as Juice, Wine, Candy or Animal feed (Akyereko et al., 2022) (Technoserve, 2017), urgent measures are required to address these concerns, promote sustainable practices, and optimize the utilization of cashew resources for the sector’s sustained growth

Social issues persist within the cashew industry, spanning inadequate rural infrastructure, enduring rural poverty, the regrettable prevalence of child labor, and the insufficient empowerment of women who play a vital role in various aspects of the value chain, including fruit and nut collection, processing, and packaging. Consequently, these challenges impede productivity and profitability for producers and women, while simultaneously casting a shadow over the industry’s reputation in terms of social sustainability.

Governance issues such as lack of transparency and accountability, weak regulatory frameworks, market monopolies and power imbalances and limited access to finance and credit lead to information asymmetry, unfair pricing practices, inequality and undermine the wellbeing and interest of farmers, their communities and other stakeholders.

Although several initiatives have attempted to align with global certification schemes like RainForest Alliance and Fair Trade into the sector, these have focused more on efficient production or market access and not value addition, or rural infrastructural development.

How can we leverage ESG and carbon footprint reduction efforts to drive sustainability in the cashew nut export value chain? And how can we ensure that these efforts have a positive impact on stakeholders, from smallholder farmers to consumers, while also creating value for the industry? Have these concerns received necessary attention and interventions? These are critical questions that we must continue to explore as we work towards a more sustainable and equitable future for the cashew industry.

ESG and Carbon Footprint Reduction Projects in the African Cashew Nut Export Value Chain

Effective implementation of sustainability initiatives requires a systemic and collective approach, involving all stakeholders across the value chain to begin to pay closer attention to the holistic impact of their activities, firmly committing to reducing their carbon footprints and adopting sustainable practices in their operations.

However, strengthening ESG has to be approached from beyond investor-readiness or meeting consumer expectations and focus on tangible sustainable and gradual impact, as the clamor for “Net-Zero” status in record time, has led to more harm than benefits.

Some notable projects on the continent with strong ESG perspectives include;

USDA West Africa Cashew Project (PRO-Cashew) (2019-2024) implemented by Cultivating New Frontiers in Agriculture (CNFA) is focused on improving the quality of production at smallholder farmer level and efficiency of trade across the value chain as well as collaborating with relevant government stakeholders in five West African countries (Benin, Burkina Faso, Côte d’Ivoire, Ghana and Nigeria) to develop more coherent regional trade and investment policies.

The project worth $47.3 million anticipates its impact to extend to 728,516 people, improving farmers’ skills to achieve better management practices over 106,822 hectares, promoting climate risk reduction, and/or natural resource management. It is set to create 340 jobs and facilitate annual sales worth $133.6 million for farmers and firms, among other objectives..

PROSPER CASHEW (October 2020 – September 2025) launched by the USDA and implemented by Technoserve in West Africa aims at providing farmers with tailored technical assistance and other supply chain actors with access to working capital to enhance cashew processing in the region.

Prosper Cashew is seeking to elevate the cashew processing capabilities of Côte d’Ivoire, Ghana, and Nigeria to half of its overall production volume. This will result in the sale of over $200 million worth of processed cashew products across local, regional, and global markets, while creating a minimum of 4,500 new job opportunities with a 50% minimum allocation for women.

Competitive Cashew initiative (ComCashew)/Africa Cashew Initiative is a multi-year program funded by the Bill and Melinda Gates Foundation (BMGF) and the German Federal Ministry for Economic Cooperation and Development (GIZ) between 2009-2018 to strengthen the competitiveness of cashew value chains in Cote d’Ivoire, Ghana Benin, Burkina Faso and Mozambique.

ACI reported successful training of 512,000 cashew farmers with about 19% (97,280) of these being women on climate smart agronomic practices, post-harvest practices and business management and raising installed cashew processing capacity from 50,000 MT in 2008 to 344,550 MT in 2018, thus improving the livelihoods of cashew communities in target countries and helping processors to increase the volumes of raw cashew nuts processed.

In a call with Mr. Yakanab of AgriCo Ghana limited, a participant of the project, he confirmed a significant impact of this project to be the development of a farmers database and zoning of farmers to form Cashew nut catchment areas for easier coordination of capacity building trainings as well as bridging the input supply and market access gaps.

Other project includes Innovating the Cashew Value Chain in Tanzania by Danida Green Business Partnerships(DGBP-CARE), The Agro Processing, Productivity Enhancement and Livelihood Improvement Support (APPEALS) project in Nigeria and The Cashew Nuts Sector and Agricultural Entrepreneurship Development Support Project (PADEFA-ENA) in Benin republic.

These projects are proof of global attention on ensuring the sustainability of the industry on the continent. However, challenges such as easy access to and use of improved medical, financial services and internet services remain. Also, the impact of these initiatives needs to be evaluated based on robust data of meaningful ESG and carbon footprint reduction parameters, with reports published to validate long term sustainability.

Future Outlook

Insights from our interview with Queen Ruga, an environmentalist based in Tanzania show that sustainability comes at a cost which may stall the adoption at different levels but more at the production level due to resource limitation of small holders, hence the development, approval and effective implementation of enabling, up-to-date regional and national policies, regulatory initiatives and incentives, as well as the prioritization of rural infrastructure development are pivotal to increasing private sector led interventions for the successful and progressive realization of ESG in the sector.

Current and future projects need to enhance the access and use of improved production technologies such as geographic information systems (GIS), agricultural drones and tailored decision support systems (DSS) for data-driven decision making, enabling precision agriculture for resource use optimization i.e producing more with less and profitability but also ensure efficient eco-friendly domestic processing systems.

Finally, addressing the recent prevalent Greenwashing issues will require the deployment & monitoring of transparent industry frameworks, leveraging technology such as blockchain for complete traceability on sustainability at all stages of the value chain and enforcing reporting according to global sustainability standards like Global Reporting Initiative (GRI) to back food labels and company claims and guarantee food safety for consumers.

At AGmimble, we enable direct connection to producers in Africa as well as enable food processors in the US digitize their entire supply chain thus facilitating direct market access for producers and improving traceability and efficiency of international trade between all parties contributing to improving rural livelihoods and shared prosperity, fostering a stronger and more efficient food system for all.